december child tax credit 2021

In 2021 only the federal child tax credit was temporarily boosted to a maximum of 3600 per child under President Bidens plan. Starting December 1 2017.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

However standard text.

. 2021 HRB Tax Group Inc. Enter the number of qualifying dependents between the ages 6 and 17. The Disability Tax Credit.

For 2021 and only 2021 the child tax credit was substantially improved. 37 million children out of poverty in. HR Block Maine License Number.

The credit amount jumped from 2000 to 3000 for children six to 17 years old notice the additional year added to the. 10-2021 Form 886-H-EIC October 2021 Department of the Treasury Internal Revenue Service. Receives 4500 in 6 monthly installments of 750 between July and December.

Under the enhanced. Does not include in-person audit representation which is sold separately. Taxpayer Identification Number Tax year.

The IRS is no longer issuing these advance payments. Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year 2021. A taxpayer has access to the DTC when Canada Revenue Agency CRA formally approves the T2201.

Enter Payment Info Here tool or. Elaine Maag of the Urban-Brookings Tax Policy Center looks at lessons learned from the 2021 advance child tax credit and its potential political future. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return.

Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021. From July to December of 2021. Who is Eligible.

The IRS was able to issue up to half of an eligible households credit as an advance disbursement from July through December 2021. The 2021 Federal budget announced proposed changes to the Disability Tax Credit DTC to broaden its scope and provide more clarity. Receives 4500 after filing tax return next year.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Estimate Your 2021 Child Tax Credit Advance Payments. Child Tax Credit.

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Catalog Number 35113Q wwwirsgov Form 886-H-EIC Rev. Neither H.

However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of the money. These proposed legislative changes are now law with an effective date of January 1 2021. Read on to learn more about ITIN and the Child Tax Credit.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. Special Rules for 2021 Only. Enhanced funds were distributed on a monthly basis to help ensure struggling families a more constant stream of guaranteed income.

The IRS is sending families half of their 2021 Child Tax Credit. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. The 2022 Child Tax Credit is available to parents with dependents under the age of 17 at the end of the year 31 December 2022 and who meet certain eligibility requirements.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Schedule 8812 H R Block

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

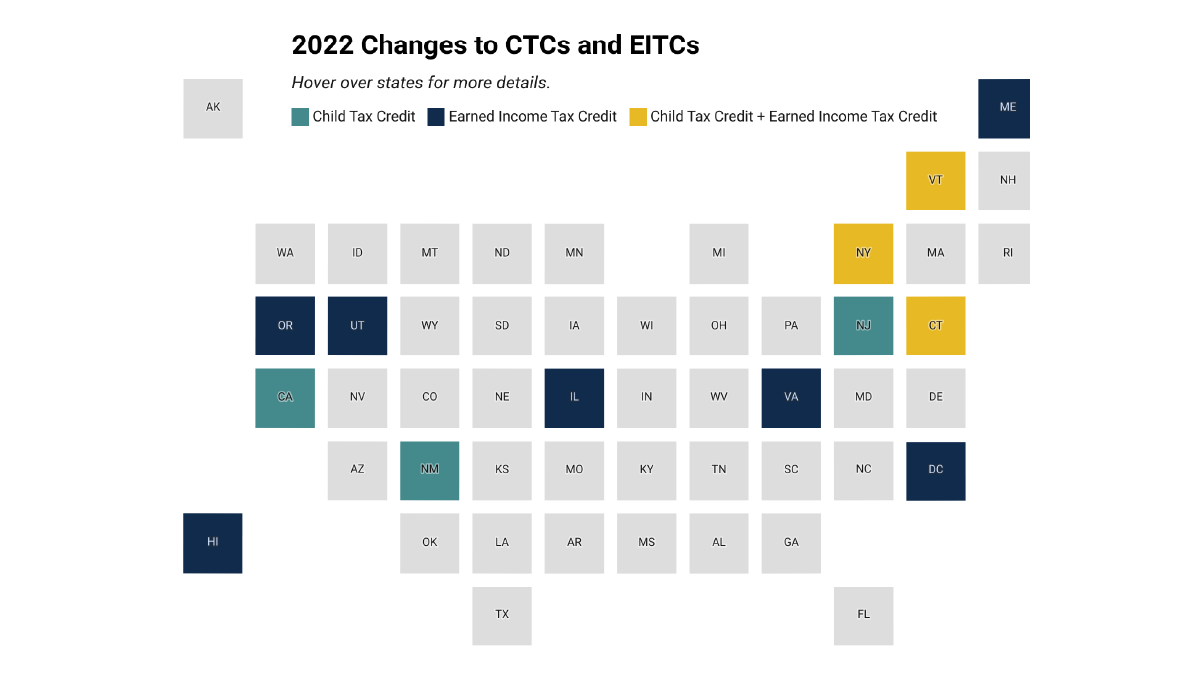

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The Future Of The Child Tax Credit Tax Pro Center Intuit

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Child Tax Credit Toolkit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

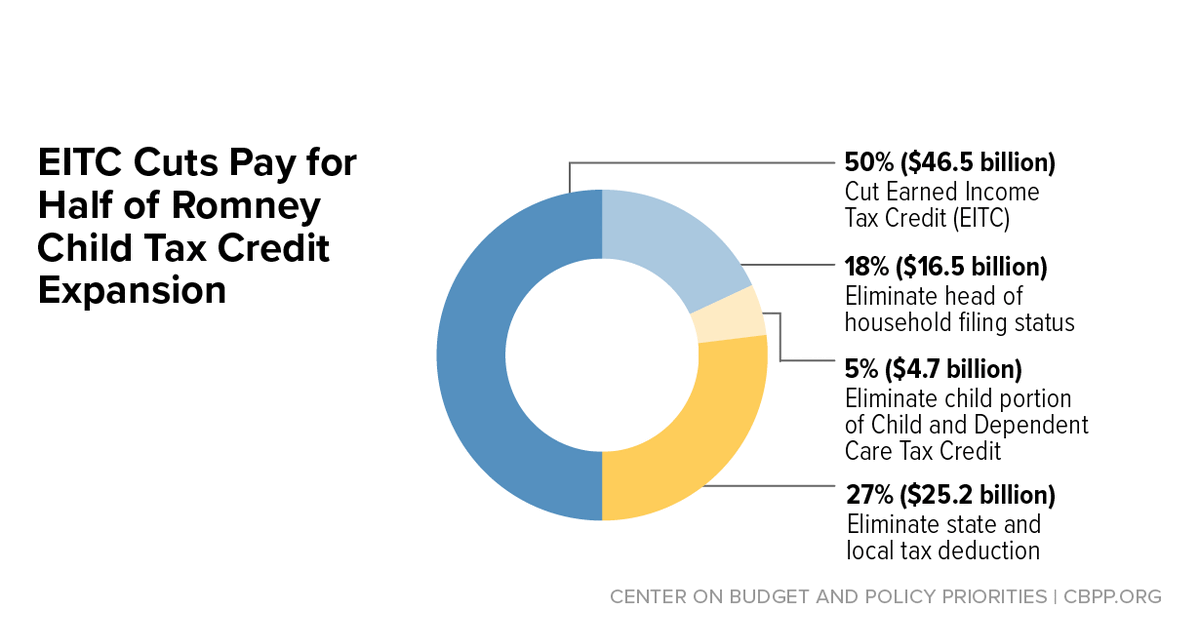

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities